As the largest adult population group in the US, millennials wield $1.4 trillion in purchasing power, and more of them are aging and earning their way into the real estate market.

If you explored Twitter recently, you’d likely think that inter-generational squabbling has reached new heights. In a flurry of contentious posts, the trending “OK boomer” meme has highlighted the divide between millennials and baby boomers. Even cultural icons like William Shatner have joined the fray.

However, despite the often-strained, less-than-cordial relations relations between the two age groups, it is increasingly apparent that both sides agree on at least one thing: Just like their elders, millennials see home ownership as an essential part of the American experience.

Millennials Want to Buy Homes

Like any market, real estate is driven by supply and demand, and demand is strong among millennials. One 2018 study found that a whopping 9 out of 10 millennials are interested in purchasing a home. The same study showed that those millennials intend to act on that interest, albeit with some variance in their expected timelines.

Of millennials who plan to buy a home, just 4% expect to buy in the next year, while a whopping 85% want to buy at some point in the next 2 or more years. If economic conditions allow, we can expect to see many more homeowning millennials in the years to come.

The important question is whether millennials will be able to afford to buy the homes they so desperately desire. Despite 2019 seeing slower growth in real estate markets nationwide, making a competitive offer to buy a home is still out of reach for many younger buyers.

Recession: A Coming of Age Story

The Pew Research Center defines millennials as the population born between 1981 and 1996 (ages 23 to 38 in 2019). When the global financial crisis hit in 2007, younger millennials were in middle school, high school and college, and the older half were young professionals just beginning to build their careers. The difficult economic conditions in which millennials came of age have had lasting effects on their long-term earning potential and their overall economic outlook.

Millennials had a front row seat to the havoc wreaked by subprime loans, unscrupulous lenders, overextended borrowers and unchecked debt markets. Many parents of millennials struggled financially in the years that followed, and some lost their homes. With firsthand experience of the dangers of debt, it seems that millennials have vowed not to suffer a similar fate.

For example, credit card debt among millennials is significantly lower than that of previous generations. Millennials average $3,403 of credit card debt, baby boomers average $5,603, and Gen-Xers average $6,752. Millennials also hold less mortgage and car loan debt. What millennials do have, though, are student loans—and boy do they ever: millennials hold an average of 182% more student debt than their college graduate counterparts in 1995.

In short, millennials are cautious. But while they remain wary of overextending themselves, that won’t stop them from buying their slice of the American dream. In fact, millennials already make up the largest proportion of the home-buying market.

How I Met Your Realtor®

Spending habits aren’t the only way in which millennials differ from their predecessors. In the same way that dating apps have digitized the world of romance, the internet and real estate apps are poised to revamp the traditional home buying experience.

The days of the Yellow Pages and lookie-loo buyers are fading into obscurity, replaced by a savvy and well-researched consumer base. According to the National Association of Realtors®, at least 81% of millennials who already own a home found their property through a mobile app. Millennial buyers tend to know what they want, and that includes fast and attentive service.

Millennials also want different types of homes than previous generations. They are trending away from 20th century McMansions, instead preferring smaller, more manageable properties. They are seeking features and amenities that suit their lifestyles, from pet-friendly yards to space for organic gardens. Millennials may prefer cozy locations within walking distance of local shops and nightlife, in lieu of a sprawling estate on the edge of town. From the way that millennials meet their agent, to the way they choose their home, technology and the internet age are pressuring the industry to adapt.

A Guiding Hand

At the end of the day, partnering with a veteran agent for expert guidance and tailored service is still key to buyer success. The home buying and selling process is sure to change further as young blood enters the market and new technologies arise. Those real estate agents who do not provide sufficient value to their clients will fall by the wayside. On the other hand, agents who leverage their market insight, their local connections, and their dedicated role as trusted advisers, will find continued success.

Whether you’re a first-time buyer looking to start building equity instead of throwing away rent each month, or if you’re a seasoned homeowner looking to make a move, we have the experience to help you succeed and the track record to back it up.

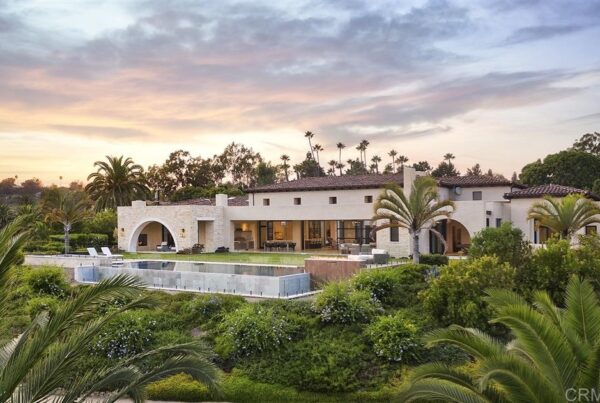

At Caspersen Brothers & Associates, we strive to provide value to our clients buying and selling real estate in San Diego and North County. We get our clients the best terms, the best offers, and the best opportunities. We dedicate our waking hours to help guide you through one of the biggest decisions of your life, because it’s what we love to do. Don’t hesitate to reach out and let us know how we can help!