Many analysts predicted the COVID-19 pandemic would decimate the housing market, but the opposite has happened. Mortgage applications are trending upwards as people want to buy their first home or refinance interest rates.

We know what you’re thinking: Should I lock in my mortgage rate today?

Keep reading below to learn about why now is the best time to get a deal on real estate.

How COVID-19 Affected Real Estate Market

The current home market is opening up opportunities for certain kinds of buyers. But, the fact is the economy is struggling through the pandemic and it will take some time to rebound.

Even before COVID-19, higher home prices made it tough for buyers. There has also been a growing shortage in housing inventory since the 2008 crash.

So far this year home prices are decreasing and interest rates are at a historic low.

The virus has also made it difficult to visit potential homes. Many realtors now use virtual home tours to target specific audiences, save time, highlight key features, and more.

Should I Lock in My Mortgage Rate Today?

Now is a great time to purchase a home if you are a certain kind of buyer:

- You have cash saved for a down payment

- You’re flexible about a closing date

- You can demonstrate strong job security

The timing is perfect for first-time buyers—not worried about selling their current home—and real estate investors.

It’s harder selling a home right now so buyers trying to unload their old property may be delayed.

As a buyer, your most important consideration should be job security during COVID-19. Are you confident that your office won’t be closed or you won’t be laid off? If the answer is no, it’s not the right time to buy.

Taking Advantage of Current Refinance Rates

Another option for homeowners is to refinance. They could get something lower than their current home interest rates.

The average rate is under 3% but it’s important to remember that mortgage bank rates differ from lender to lender. Some may be 2.8% while others could be 3.1%. This means you’ll need to shop around and check the actual APR rate.

Refinancing can get you lower monthly payments, a shorter loan, or more home equity. But, you’ll want to use a refinance calculator to make sure you’ll benefit in the long run.

It all depends on your “break-even” point and the total length of your original loan. A few bad calculations can result in losing money.

Don’t Miss Your Chance to Buy or Refinance

Now, if asked “should I lock in my mortgage rate today?” you know what our answer will be: “what’re you waiting for?” Don’t miss your chance!

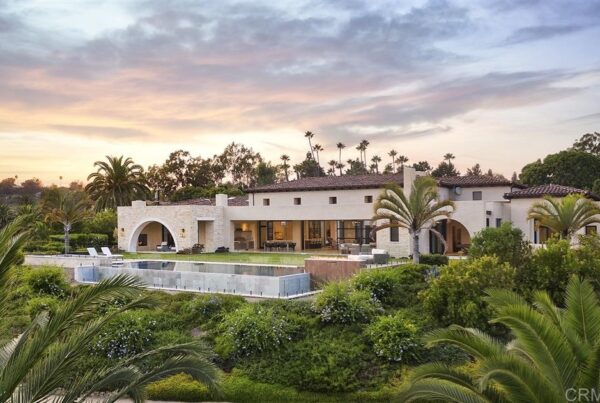

We understand how buying a home is a huge investment. Our role at Caspersen Brothers & Associates is to help our clients find their dream home in San Diego.

Contact us now to get the process started.